2025

Company

Concept project

Role

Product Designer

Product Manager

Platform

Mobile

Desktop

Scope

AI Fintech

Behavioral design

The challenge

There’s a well-known problem among my group of friends: no one saves money. Not just because life in Madrid is expensive, but because none of them know how. Tracking expenses feels like a mental burden and only adds stress.

Most financial apps let you track money, but very few actually help change spending habits. As a result, many users:

Don’t fully understand their spending patterns.

Feel guilty every time they log an expense.

Eventually give up on using financial tools.

What if the problem isn’t how much you spend, but why you spend it?

Saving money shouldn’t be a burden.

Discovery

I researched financial behavior and habits in my environment.

User insights

Most financial decisions beyond basic needs are emotional.

Users need guidance, not just data.

Personalization drives engagement.

Market research

Current apps focus on control and require users to log every expense.

There’s little exploration in adaptive coaching.

Key insight

Users don’t need more data. They need interpretation and context-aware guidance.

Design principles

Reduce financial anxiety

Shift from control to coaching

Personalization over static

Small wins

build habits

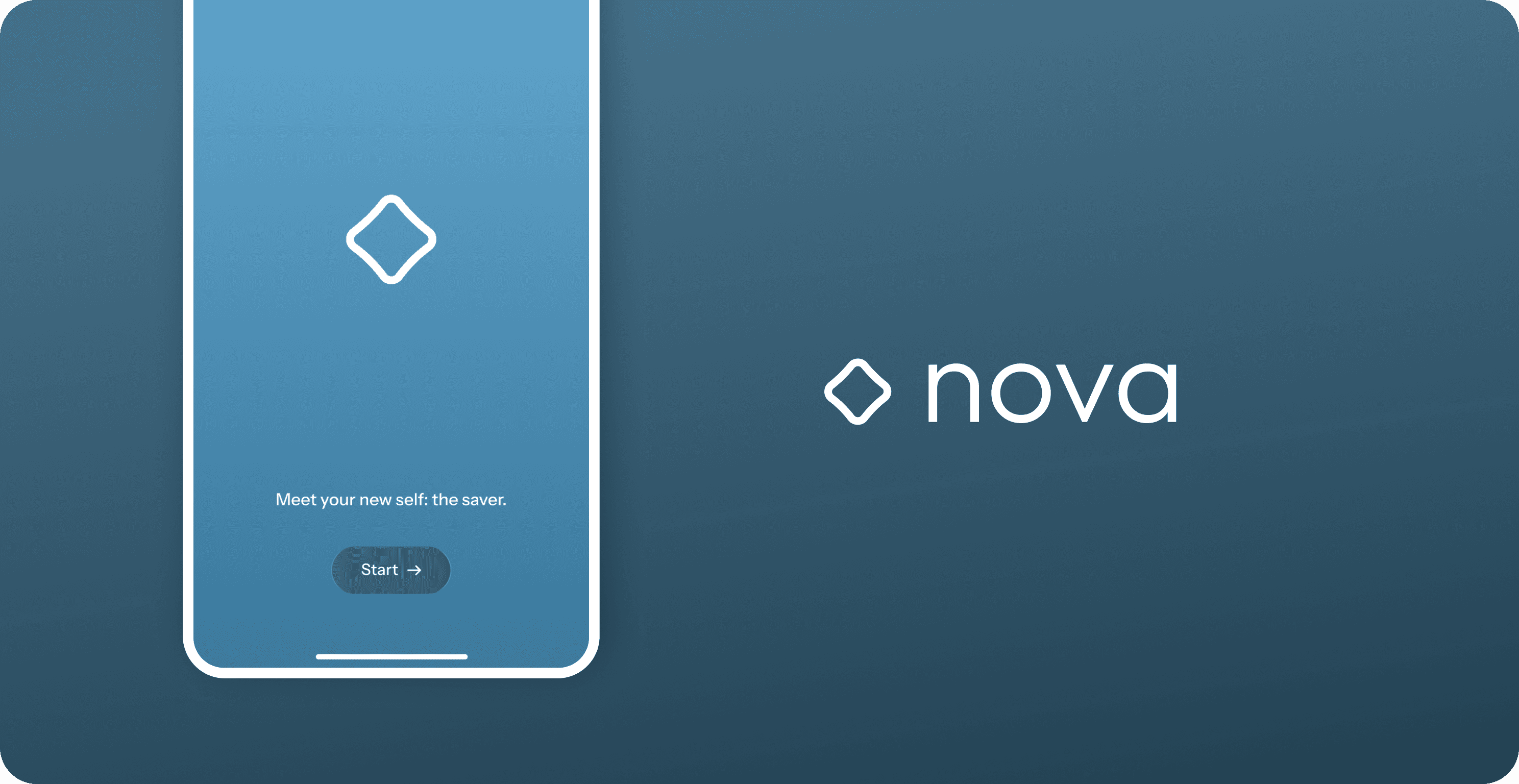

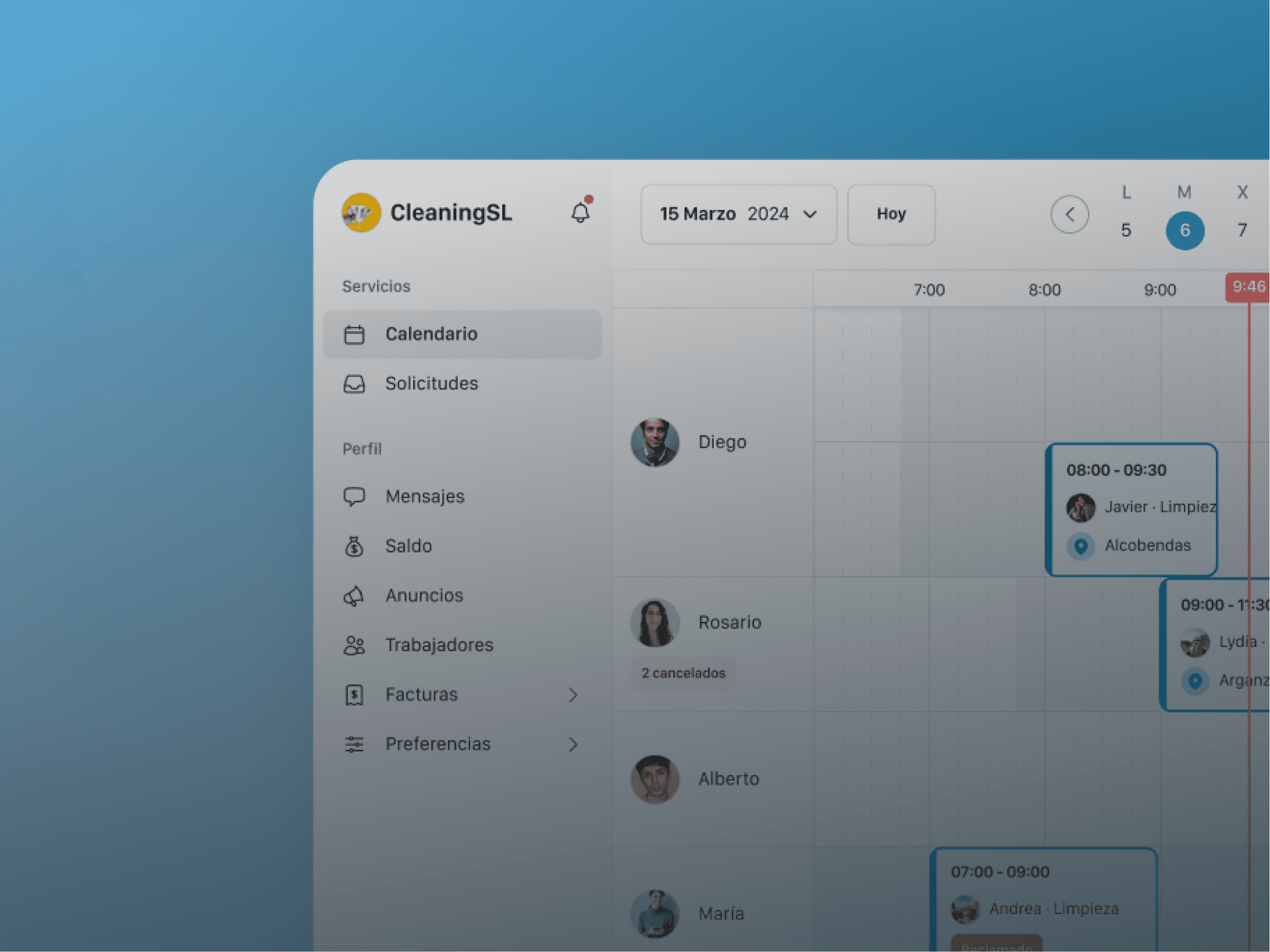

Say hello to Nova.

Solution

I designed an AI-driven financial coaching system focused on behavioral change rather than purely transactional financial management.

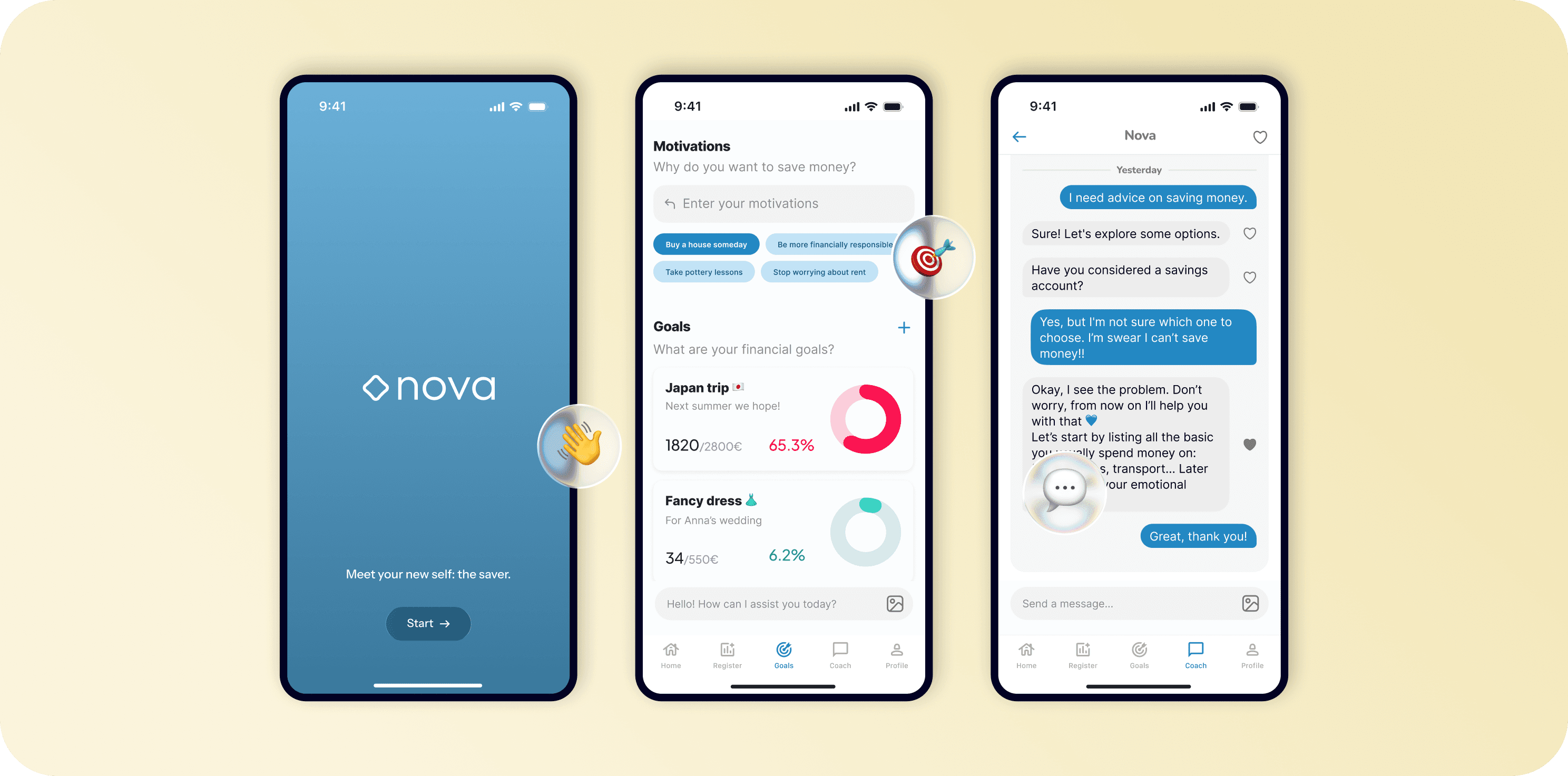

Core experience

Personalized insights based on user behavior patterns and financial habits.

Adaptive recommendations that evolved as users progressed.

Real-time feedback to support everyday financial decisions.

Dynamic financial plans that adjusted to changing goals and life contexts.

Key features

Conversational coaching powered by AI.

Adaptive goal-setting aligned with user behavior and motivation.

Progress visualization combining both emotional and financial dimensions.

Contextual nudges delivered at key decision-making moments.

Design focus

Behavioral psychology as the foundation for product strategy and interaction design.

Building trust in AI through transparency and predictable interactions.

User control and clarity in financial recommendations.

Explainability to help users understand the “why” behind every suggestion.

Expected impact

Key learnings

Financial behavior is deeply emotional, not purely rational.

AI must build trust, not just efficiency.

Sustainable habits are built through small, consistent changes.

Check other projects